Dominique Turpin answers how will Europe be affected by electric vehicle tariffs on China?

The EU previously issued an announcement on its decision to impose a five-year countervailing duty on imports of electric vehicles from China. At the same time, the announcement said that the EU and China will continue their efforts to find alternatives that are in line with WTO rules. Currently, the two sides are continuing consultations.

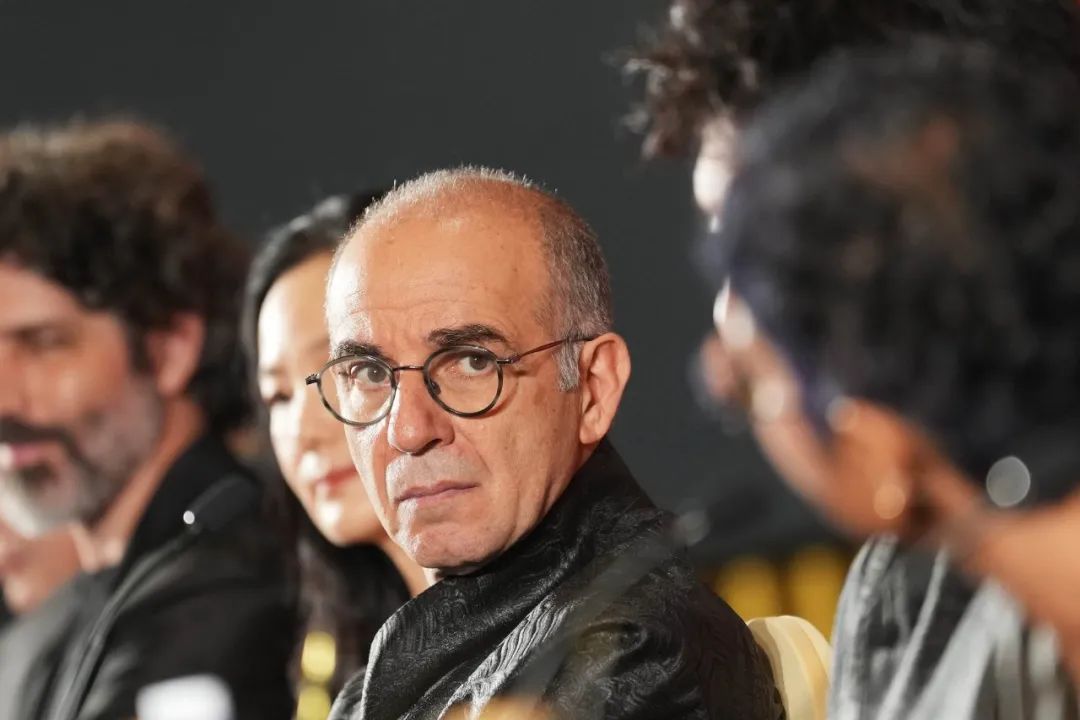

Since the launch of the EU’s countervailing investigation, Germany, Hungary and Slovakia have expressed their opposition, and major European carmakers such as Volkswagen, BMW and Mercedes-Benz have unanimously opposed it. How does the European business community view this EU approach? What impact will the imposition of tariffs have on European carmakers and China-EU economic and trade exchanges? The European President of China Europe International Business School (CEIBS), Dominique Turpin, was recently interviewed by East Meets West on these issues.

Dominique Turpin is the European Dean and Professor of Marketing at China Europe International Business School (CEIBS). Currently, he also serves as a trustee of the European Foundation for Management Development (EFMD) and as a member of the International Advisory Board of prestigious institutions such as Stockholm School of Economics (SSE) and Waseda University Business School in Japan, and has been serving as a member of the Academic Committee of CEIBS.

The European Union has decided to impose tariffs on Chinese electric cars, and European carmakers such as Volkswagen, BMW and Mercedes-Benz are opposed to the move – why? How will the tariff increase affect them?

German carmakers are indeed in a difficult position. Companies like Volkswagen, BMW and Mercedes-Benz have invested heavily in the Chinese market.

In 2023, Audi will deliver about 1.9 million vehicles to customers worldwide and more than 729,000 in China. As these companies derive a significant portion of their profits from the Chinese market, they are concerned that the high tariffs set by the EU could lead the Chinese government to take the same measures. If China were to impose reverse tariffs on European exports, German carmakers would lose considerable market share, which would severely affect their profits and could lead to mass unemployment in Europe.

This comes after Volkswagen announced plans to close at least three plants in Germany and downsize all remaining plants. European carmakers fear that these tariffs could backfire, damaging both industry and jobs in the EU.

What is the impact of China’s role in new energy vehicles on the transformation of the European and global automotive industry?

China’s role in the global automotive industry, especially in electric vehicles, cannot be ignored. Chinese automakers have demonstrated an amazing ability to adapt, continue to transform and actively embrace innovation.

One of the major advantages of Chinese companies is that they are starting from scratch and can innovate more freely, unlike some European and American companies or Japanese companies, which tend to be constrained by their historical ways of operating.

China also benefits from a large domestic market, which brings economies of scale. For Chinese manufacturers, the cost per unit of producing cars for a market of 1.4 billion people is lower than for firms with much smaller domestic markets, such as French manufacturers.

In addition, Chinese manufacturers are known for their speed of production and new product development. A few weeks ago, I met a Chinese executive who mentioned a recent visit to an established European automaker’s factory, where production was surprisingly slow. This ‘Chinese efficiency’ alone, combined with the speed of innovation and the sheer scale of production, already provides Chinese EV makers with a significant competitive edge.

With the current increase in global trade barriers, how do you see the prospects for the development of China-EU economic and trade relations? How will this affect global trade?

Despite the challenges, there is a potential model of cooperation between Europe and China that could benefit both sides. If Chinese companies were to establish production facilities in Europe, this would create jobs, facilitate technology sharing and contribute to the local economy.

When Japanese companies faced similar trade frictions in the 1980s, they were forced to set up factories in the United States and Europe and integrate into the local economy, eventually winning acceptance from local manufacturers and consumers. If Chinese automakers take a similar approach, it could lead to a win-win outcome for all parties involved.

The future of the electric vehicle industry in the EU and China holds great potential for both sides, provided a win-win solution is found. Chinese carmakers will be more than welcome if they follow a ‘shared value’ model where all key stakeholders, including the company, subcontractors, the state, workers, consumers and shareholders, benefit from value creation.

Chinese carmakers could become a powerful economic force in the European market if they address quality perceptions, introduce differentiation and meaningful innovation, and especially invest in local production. It won’t be an easy road, and they will need to tackle regulatory hurdles and win consumer trust. In the long term, we could be looking at a new era for the automotive industry – one characterised by shared goals, economic resilience and mutually beneficial growth across borders.

If you liked this article why not read: Peter Singer: Can Artificial Intelligence Ethics Cross Species Boundaries?